Quick Guide to Sales Tax at MIT

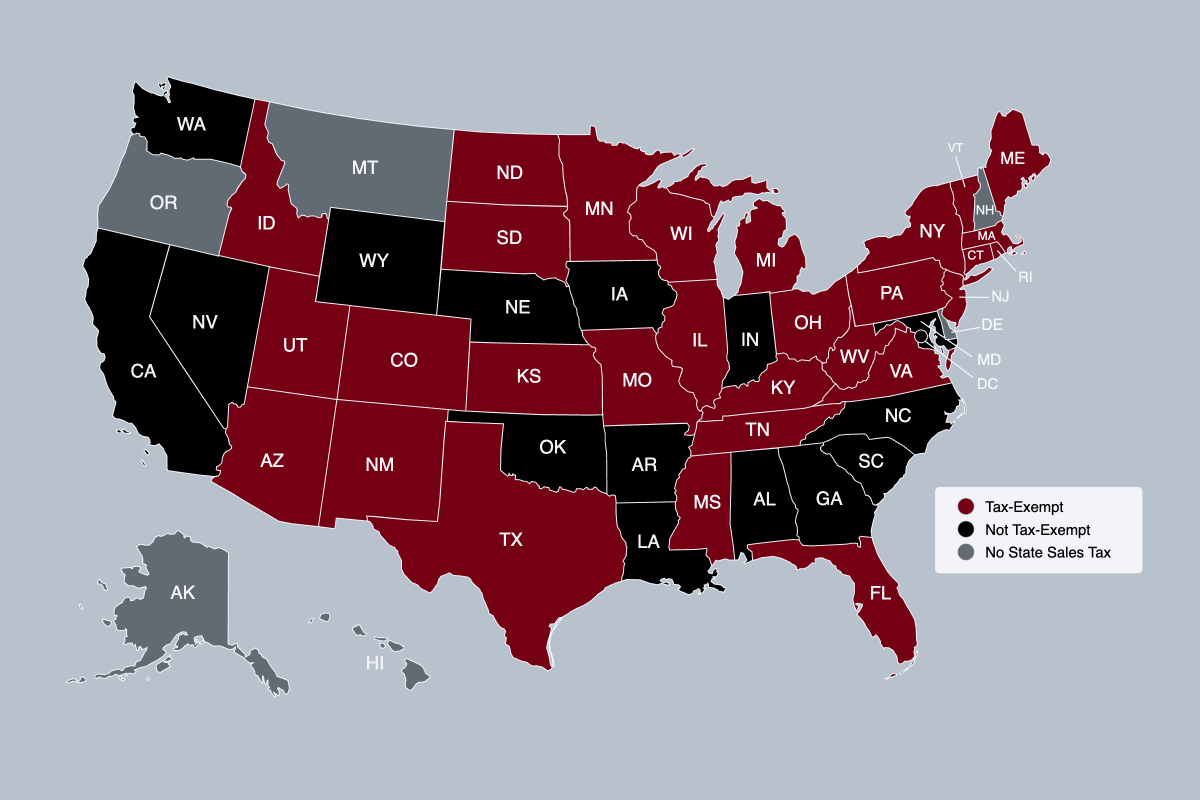

MIT is exempt from paying sales tax in Massachusetts and 29 additional states in the U.S. If you are making a purchase from any of the states listed on the MIT Sales Tax Exemptions by State page, you can provide the supplier with a MIT’s tax-exempt number or a copy of MIT’s sales tax exemption certificate for that state to document MIT’s exemption.

MIT’s Massachusetts Tax-Exempt Number is printed on the front of your Procurement Card. You can give this number to a supplier when making a purchase on your card from a local supplier.

A few tax facts of note:

- When purchasing goods for MIT, a supplier will typically request that you provide both Forms ST-2 Certificate of Exemption and ST-5 Sales Tax-Exempt Purchaser Certificate.

- Hotels in Massachusetts and many other states charge an occupancy tax. This is not the same as sales tax, so you will not be exempt from paying it. This expense will be reimbursed in travel expense reports.

- If you make a purchase for MIT using your own funds, you should provide MIT’s tax ID number or tax-exempt form before completing the purchase to avoid being charged sales tax. If you do end up paying sales tax, note that you must remove the sales tax from your reimbursement request, as MIT will not reimburse the sales tax. Once charged tax for the purchase, the seller (restaurant, bookstore) is unlikely to remove the tax after the sale is made.

- MIT’s sales tax exemption may only be used for Institute business and may not be used for personal purchases.